Unlike other Caribbean islands, buying in Cayman has no restrictions on foreign ownership. Every property in Cayman is registered under a unique block and parcel number, which means every owner is registered with the Government guaranteeing the right of ownership. A potential purchaser may examine the public records regarding any property to check whether there are any liens, charges or restrictions on it.

When buying in Cayman the purchasing process is relatively easy. The prospective buyers presents personal documents, including certificates of identification and confirmation of the source of funds. Buyers then file a “Search and Stay” status on the land with the Department of Lands and Surveys upon entering into a contract. This essentially grants the purchaser a priority period during which the property is put on “freeze”, preventing any other interest from being registered against the land until the property has been officially transferred.

Unless stipulated within a particular development, there are no time deadlines for building on raw land. The land can be held undeveloped indefinitely; you can land bank now for your future generations. Planning approvals are valid for five years following the grant of planning permission.

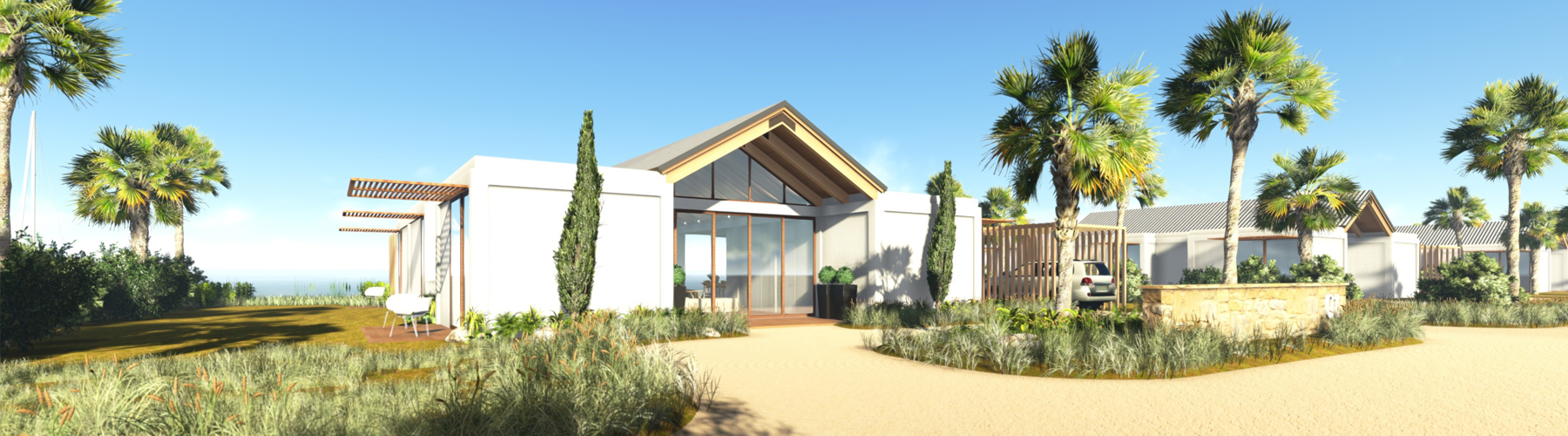

Building time in Cayman is relatively fast. Most homes up to 3,500 sq ft can be built within a six to eight month period, meaning it is possible to have an architect design a home and obtain panning approvals and prices, and have the home built in just over a year.

It is important to take local legal and real estate advice when buying land in Cayman. If you are thinking of buying land in Cayman do your due diligence. Legal and other registration costs can add around 1% to 3% of property value to the total cost.

7.5% Stamp Duty is payable on all real estate transfers and purchases, other than those between close family. Stamp Duty is paid by the buyer, on the purchase price or the market value, whichever is assessed higher by the Lands and Survey Department. The Duty must be paid within 45 days of a contract being signed.

When building a house, Duty is payable only on the land value and not on the building after it has been built. There are building permit fees, which are charged according to the square footage of the property being built.